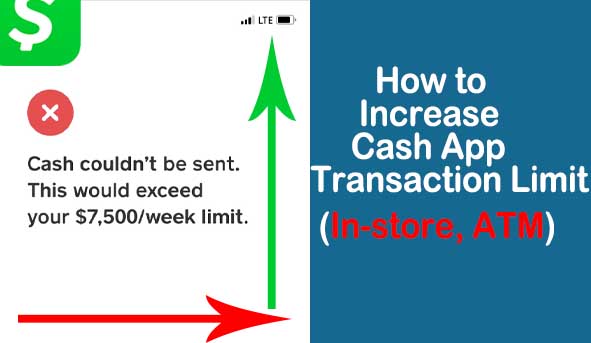

Getting your online business started can be overwhelming. There’s a lot of information on the internet from eCommerce websites to blogs and forums. You need to be able to sort through all the data and find useful information. One way to get started is by creating a store for your website or blog and selling products. However, another common question asked by most people is how to increase their cash app transaction limit, one of the easiest and most secure ways by which goods and services are paid for online or in-store.

Yes, I know it’s a question that everyone is looking for an answer to. The transaction limit will allow you to use certain services on the Cash App such as Venmo, Apple Pay, and Google Pay. In order to get a higher transaction limit on your Cash App account, there are a couple of things that you need to understand about them.

Without wasting too much of your precious time. Let me give you a brief recap of what answer this article will be giving you regarding your question.

Read Also: How to Get Free Money on Cash App

How Can I Increase The Cashapp Transaction Limit Myself?

The Cash App is a great app for sending money to friends, family, and other people you owe. However, there are limits to how much you can send per transaction. Fortunately, the Cash App allows you to increase your transaction limit if you need to send more than $2,500 in one day. Follow these steps to increase your Cash App transaction limit.

If you need to increase your limits from: for instance $2500 to $7500 on the Cash App, you can do so with a couple of steps. First go to the Settings tab, then tap “Bank Account” and click “Edit.” You’ll be asked to provide your account number and routing number. Once you’ve done this, you can request an increase in your daily limit by tapping the green “+” button at the top of that screen.

To discover more on how to get a Paypal QR code, continue reading this post to know more interesting things about the PayPal QR code itself.

It is important to talk a little about what Cash App is for the sake of those who are just hearing this for the first time. But if you are not new to this, you can always skip straight to the main content by scrolling down.

What is Cash App?

With the rise of cryptocurrencies and their technological ability to replace traditional financial institutions, CashApp seeks to change the way society banks by providing a new innovative way to transfer money to anyone who has an email address. Or as they state on their website, “CashApp is changing the way the world sends and spends money.

You can hold, store and send money straight from your phone with no fees or need for a bank account.”

CashApp is a new peer-to-peer money transfer app that has captivated the attention of many users. The app is great for a variety of reasons, but it presents risks to the user.

Now that we know what exactly Cash App is and what they represent in the world of online transactions today. It does well to now know what the transaction limit is.

What Is A Transaction Limit?

A transaction limit is the maximum amount of funds that an individual, business, or organization can be debited at one time. Financial institutions may place restrictions on how much money can be processed in a single transaction to protect themselves from risk. For businesses and organizations, a transaction limit is set to prevent people from embezzling large sums of money. If a particular transaction exceeds the maximum amount, the processing institution will automatically reject it.

Therefore, Cash App has set up a transaction limit on your general account where you can not do more than $800 or $1,000 worth of transactions in the given month. Certainly, this is to stop and avert money laundering activities into their accounts.

The apparent reason behind this is that Cash App is trying to make its platform compliant with local financial regulations of the United State of America.

Most people are using it for two reasons;

- The number of transactions you do through the app is directly proportional to their cash rewards points program which you can redeem to get some extra cash from them.

- They want to avoid a situation where they have people transferring money to their bank accounts or credit card and immediately requesting refunds.

So you want to increase your cash app transaction limit? Maybe you need some more money to play with, or perhaps you are just tired of seeing the “Payment Error” message when you try to send $500 to your buddy.

Cash App transaction limits can be frustrating, but they’re easy enough to change. All it takes is a few quick steps and your Cash Card limit will increase shortly.

Hopefully, now you understand a little bit more about how Cash App transaction limits work. Though you can’t increase your initial limit, there are ways to hold yourself accountable and avoid exceeding your daily limit in the long run.

However, there are restrictions on the total amount of money you can transfer within one day. If you want to increase your cash app cash limit, follow these simple steps I will be listed below in this article to do so.

On the Cash app, users are allowed to post a maximum of $250 in cash-outs per day, and $1000 per week. However, this number can be raised by a petition to the Cash App team.

This can be accomplished by contacting them through the Cash App Support page on Twitter. There you can go through steps to get your limit increased.

Currently, the Cash App limit is $350/week or $200/week for verified users.

Read Also: How to Add Money to Cash App at ATM, Cash App ATM Deposit Steps

Types of Limits on Cash App.

There are basically three types of Cash App Limits, they are as follows:

- Payment Transfer Limit

- Cash App ATM Limit

- Direct Deposit Limit

Let’s explain what each of these limits represents and how to correct them.

1. Payment Transfer Limit.

Payment transfer limits are put in place to monitor how much money is moved in and out of your account. Additionally, if you make too many transactions, you could be flagged for fraud preventing any further transfers until a new limit is put in place. This can happen due to certain fraudulent activities, or because someone has stolen your account information.

CashApp will also limit how much money you can send. For this type of limit, you can only send up to $50 per week, or $400 per month. When you hit this limit the app won’t let you send any more money until after seven business days.

To Remove this Limit: Verify your identity using your full name, date of birth, and the last four digits of your SSN

2. Cash App ATM Machine Limit

The maximum amount you can withdraw from the ATM or any POS machine with your CashApp card is $1,000 per transaction, $1,000 per day, and $1,000 per week.

The ATM machine limit is $1000 per day and $3000 per month. To remove this limit, you’ll have to provide more information about yourself and verify your identity.

3. Direct Deposit Limit

If you’re using the Cash App, you may have noticed that the service only allows up to three direct deposits per month. This is a hard limit that can’t be changed—but if you’re looking to increase your monthly direct deposit limit, you can do it by visiting your bank and updating the information that it has on file for you.

The Cash App will work with any bank or credit union, but each institution has its own rules about how much money can be deposited into an account through direct deposit. In order to increase your limit, you’ll need to enter the necessary information on your bank’s website. It should take just a moment or two of your time, but once you’ve done it, your direct deposit limit will automatically be raised to match whatever maximum is allowed by your financial institution.

The great news is that you can receive up to $25,000 per direct deposit and up to $50,000 within a period of 24 hours if you are a verified customer.

How to Increase Cash App Transaction Limit

1. Seller Status

If your business makes $5000 per month through the cash app, you will most likely get an upgrade to the “Seller” status. This will allow you to accept physical checks as payment and have a lower transaction fee.

If you are qualified to be a seller, you will now be able to accept checks as payment, and the transaction fee will be reduced from 3% to 1%.

The fact that you have to go through some time-consuming steps before you can make your first few purchases is a little bit annoying, but the most irritating process is definitely the verification.

Applying for seller status on Cashapp is a pretty long and tedious process, and if you didn’t know any better, it might seem completely impossible to get accepted.

These are the requirements to get seller status on Cash App:

- Prove that you’re over 18 (legal age in the US.)

- Take a Photo of your ID or Passport, or take a photo with your ID on top of the screen

- Fill out the seller form (if you are verified)

- Make a Deposit

- Make sure that you have a Business Bank account or have a Business Bank acct attached to your personal account

Seller status on the Cash app is limited to $2000 per day at the moment. However, there are no limits to receiving money from customers.

The only thing you were not allowed to do is withdraw over $1000 from Cash App to your bank account per day.

If a cash app is being used to sell a physical product (as in the title of this question) then the transaction limit is $20,000 per month.

2. Approval From A Bank

The maximum amount of money you can withdraw from the bank is $1000, However, if you want to withdraw a bigger amount then you need approval from your bank. In order to be able to withdraw your cash, you will need to connect your bank account by providing your username and password on the CashApp web.

This will increase your withdrawal limit from two hundred and fifty dollars to two thousand dollars. Otherwise, you cannot withdraw a bigger amount than $1000.

The application process of cash app withdrawal, If you want to withdraw money for more than one thousand dollars ($1000), demands you to get verified by the cash app customer service. Verification means your bank account has been approved by the team of cash app after you submitted documents and identification information as required.

Everyone is allowed to withdraw $1000 instantly, or up to $10,000 a month with the approval of the bank. This method works very well and you can withdraw any currency.

3. Cash App Official Requirements

Another way to increase your transaction limit as stipulated by Cashapp is that you need to verify your identity using your full name, date of birth, and the last four digits of your SSN

If Your CashApp transaction limit is currently $500 per day, and you’d like to increase your daily limit, you’ll need to verify your identity. You will be required to provide the following information:-

First name: ________________

Last name: ________________Date of birth: __________

Last four SSN number: __________

To verify your identity, they (Cash App) will send you a verification code by text message to the mobile phone number that you provide. Once you have verified your identity using this code, your transaction limit will be increased to $1,000 per day. You will be required to enter your ten-digit phone number including any spaces and dashes without brackets (For example [999] 999-YYYY) both the phone number fields are required to verify your identity

To increase the transaction limit on the cash app, contact the customer service team via the Cashapp website to confirm your identity.

4. Direct Deposit

Another way to increase your transaction limit is to make use of Direct Deposit. Though you can only make use of this if you are a verified user. you can receive up to $25,000 per direct deposit and up to $50,000 within a period of 24 hours once you are a verified customer. DO NOT MAKE USE OF THE DIRECT DEPOSIT IF YOU ARE NOT A VERIFIED USER!!!

Frequently Asked Question

Below are answers to the frequently asked question on how to increase the transaction limit on Cash App.

How Do I Increase my transaction limit?

You can increase your transaction limit by verifying your identity using your full name, date of birth, and the last four digits of your SSN

Can I receive a direct deposit into my CashApp?

The answer is Yes!!! You can receive a direct deposit of up to $25,000 at once and $50,000 within 24 hours into your account once you are a verified user on CashAPP.

How much can I withdraw at any ATM Machine with my CashApp Card?

You can withdraw the maximum amount of $1,000 at once at any ATM Machine or POS in a week.

What Is A Transaction Limit?

A transaction limit is the maximum amount of funds that an individual, business, or organization can be debited at one time.

Conclusion

Having said all these above, this is to assure you that it is possible for you to increase your transaction limit on CashApp if you can follow the steps aforementioned above.

Users must update their cash app and then scan their bank information with the app and that is it. After the bank information is verified, the cash app will let the user check their transaction limit without any problems. By taking advantage of this feature from the cash app, users will be able to have a secure and excellent way to manage and grow their money.

Though the process might seem tedious and stressful I assure you that it is worth your time.

Video Guide

Here is a Video guide on how to increase Cash App transaction limit

Read Also: Can You Use Cash App Card at ATM?

Below Are images Showing different Cash App transaction Limit Messages screenshots